unified estate tax credit 2019

January 1 2019 through December 31 2019. Confused about the new tax provisions.

Estimated 2019 Tax Brackets And Exemption Amounts For Trusts And Estates Preservation Family Wealth Protection Planning

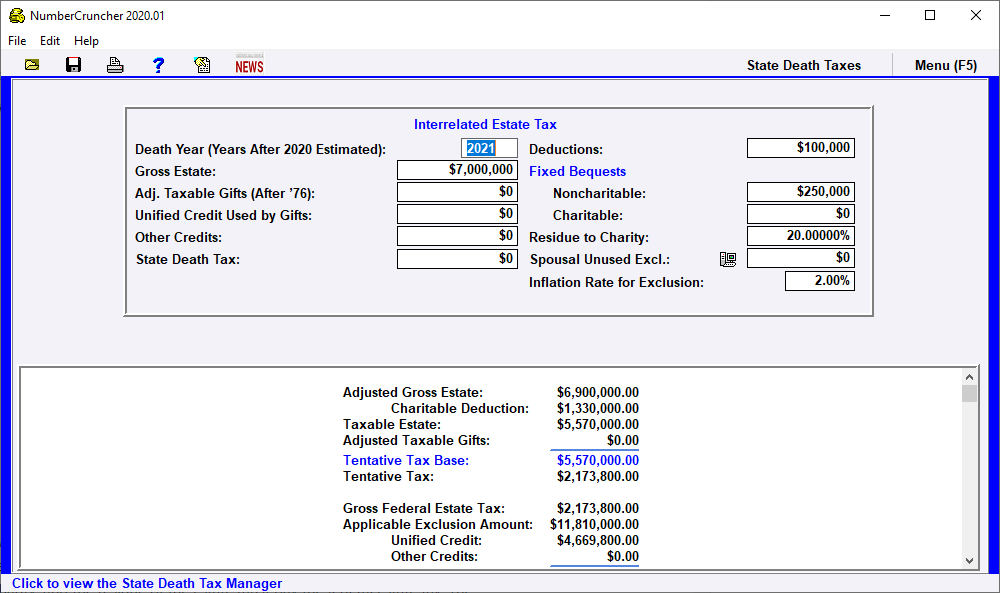

January 1 2021 through December 31 2021.

. The lifetime estate exclusion amount also sometimes called the estate tax exemption amount the applicable exclusion amount or the unified credit amount has been. If you were married your spouse also a us. The amount of the Unified Credit is currently higher than it has ever been while an estate tax is.

SOUTH PASADENA UNIFIED SCHOOLMEASURE S SPECIAL PARCEL. The California Tax Credit Allocation Committee CTCAC facilitates the investment of private capital into the development of affordable rental housing for low-income Californians. However under the 2017 Tax Act the base.

X PROBATE TERMS GLOSSARY. The IRS has issued tax year 2019 inflation adjustments for more than 60 tax provisions including tax rate schedules. 2019-06-14 Treasurer and Tax Collector Redemption Property Tax Collections Financial and Compliance Audits for Fiscal Year 2017-18.

Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. Any liens against your assets such as.

PAY YOUR SECURED REAL PROPERTY TAXES. A tax credit that is afforded to every man woman and child in america by the irs. How is the unified tax credit calculated.

But all of this is more complicated than it has to be from a taxpayers standpoint. Get information on how the estate tax may apply to your taxable estate at your death. If youd prefer to give.

January 1 2020 through December 31 2020. The tax is then reduced by the available unified credit. Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million.

2018 through June 30 2019 and the Tax Roll Year is 2018-19. The unified tax credit is an exemption limit that applies both to taxable gifts you gave during your life and the estate you plan to leave behind for others. Is added to this number and the tax is computed.

A Los Angeles County contracted vendor that processes all creditdebit card property tax payments. The Internal Revenue Service IRS recently announced that the estate and gift tax exemption is increasing next year. The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise subject to either the gift tax or the estate tax and a tax credit ie it reduces the amount of tax owed.

The increase in the base amount in 2018 was due to the passage of the 2017 Tax Acts and Jobs Act. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. Any liens against your assets such as.

How is the unified tax credit calculated. But all of this is more complicated than it has to be from a taxpayers standpoint. Five-Pay Plan A five-year payment plan that allows.

Up from 1118 million per individual in 2018 to 114. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. The tax reform law doubled the BEA for tax-years 2018 through 2025.

Inter Interrelated Estate Tax Leimberg Leclair Lackner Inc

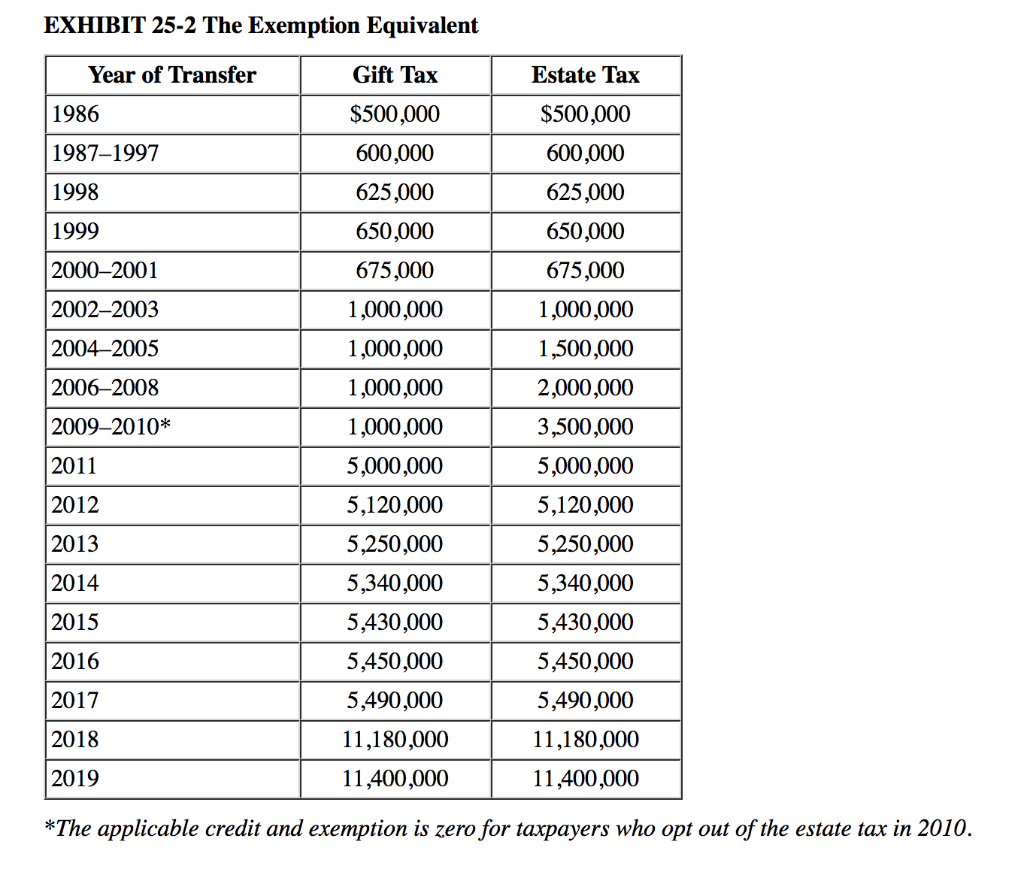

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com

2022 Estate Gift And Gst Tax Exemptions Announced By Irs Nixon Peabody Blog Nixon Peabody Llp

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Let S All Wait Until After 2023 To Die In Connecticut Lexology

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Irs Raises Estate And Gift Tax Limits For 2019 Postic Bates P C

Irs Announces Higher Estate And Gift Tax Limits For 2020

New Tax Exemption Amounts 2022 Estate Planning Jah

The Ird Deduction Inherited Ira Beneficiaries Often Miss

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Irs Raises Estate And Gift Tax Limits For 2019 Postic Bates P C

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

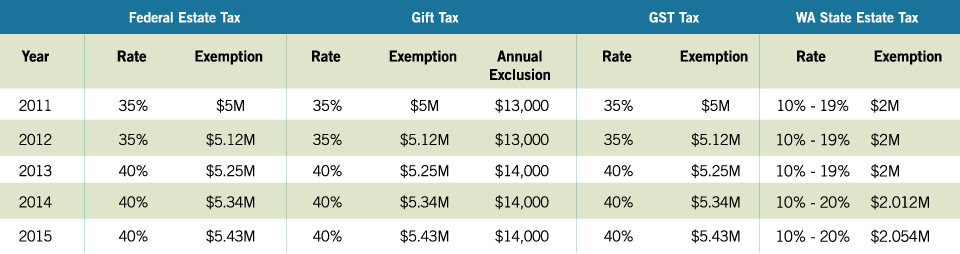

2015 Estate Planning Update Helsell Fetterman

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

Analyzing Biden S New American Families Plan Tax Proposal

Irs Announces Higher Estate And Gift Tax Limits For 2020 Senior Law

Estate Tax Rate Schedule And Unified Credit Amounts Download Table